FAQ

You’ve got questions, and we’ve got answers to questions frequently asked by our clients. Please call or write if you don’t see the answer you need.

If I fill out a mortgage application or provide any information, am I under any obligation to accept a mortgage?

No. You are never under any obligation until closing on a purchase or three days after closing on a refinance.

Can you provide information by e-mail?

Yes. No one will call you unless you request a call. If you do apply for a mortgage then phone calls will be necessary.

Can I get pre-qualified and is there a cost?

Yes, you can get pre-qualified by providing income information and permitting a credit check. We can check your credit and let you know the amount of mortgage for which you qualify. There is no cost for this service.

What documents do I need to gather and provide to apply for a mortgage?

You will need to provide the following documents as part of your mortgage application:

Government identification, usually a copy of a driver’s license

Income Documentation

Plan to provide W-2 forms (if applicable) and federal tax returns for the previous two years,

plus:

If you are employed:

● Pay Stubs covering most recent 30 days

● Contact at employer for employment verification

If you earn commission income or 1099 income:

● Copies of 1099s

● Paystubs covering most recent 30 days if applicable

If you receive retirement income:

● Pension award letters

● 1099-R forms for two most recent years

● Most recent two bank statements showing deposits of pension benefits

● Social Security award letter

● 1009-R forms for most recent two years for Social Security benefits

● Most recent two bank statements showing deposits of social security benefits

● 1099-R forms for most recent two years for retirement account distributions

● Most recent two bank statements showing deposits of retirement account distributions

● Copies of IRA statements to verify that sufficient funds are available to cover distribution level for the next three years.

If you are self-employed:

● Considered self-employed if ownership percentage is greater than 25%.

● Federal business tax returns for two years

● P & L statement for current year.

If you have rental income:

● Copies of leases

● Copies of mortgage statements

● Copies of tax/insurance bills

List of assets

● Copies of all pages of bank statements covering 60 days

● Explanation/documentation for any large unreferenced deposits

● Copies of all pages of retirement account statements if required for verified reserves

Mortgage Statements: Statements for all mortgages for any properties owned, and if tax and insurance are not escrowed, copies of most recent tax and insurance bills

Homeowner’s Insurance: A copy of the current declaration page and/or the agent’s name and contact number.

Sales Agreement/Contract: Fully executed sales agreement and addendums

Canceled Earnest Money Check/Deposit Check: Documentation to show check cleared account.

Can I get a mortgage even if I have had a bankruptcy?

Yes. There are lenders who will provide a mortgage even if you have had a recent bankruptcy. Your probability will depend on your credit since the bankruptcy.

I have good credit but I have very little money saved. Can I possibly qualify for a mortgage?

Yes. There are mortgages that require minimal down payment and allow the seller to contribute toward the closing costs. If your credit is good enough, you may qualify for that type of mortgage.

I want to buy a duplex and live in one unit and rent the other. I have good credit. Can I get the same interest rate as if I were buying a single family home?

Yes. For owner-occupied properties for borrowers with good credit, the rates are the same. If you have had past credit problems, rates may be higher.

Mortgage Resources

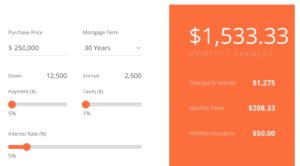

Today's Mortgage Rates

| ||||||||||||||||||||||||||||||||||||||||||